Any business or person may calculate their own effective tax rate by dividing their taxable income by their total revenue. It has to do with the total tax rate instead of the marginal tax rate of the business. The effective tax rate only takes into consideration federal income taxes & does not include any other taxes, such as state and municipal income taxes, service tax, or property taxes that a person may owe. When comparing the efficiency of two or more organizations, the effective tax rate determination is a valuable statistic.

Key Takeaways

- A person or business's effective tax rate is its average tax rate as opposed to its marginal tax rate.

- Investors sometimes use the effective tax rate as just an indicator of a firm's profitability.

- The underlying causes of changes in an organization's effective tax rate are more significant than the changes themselves.

What Exactly Is The Effective Tax Rate?

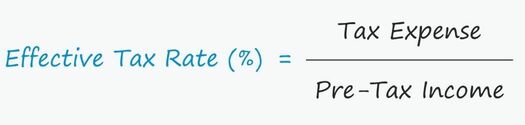

The tax rate that is noticed in the income statement is referred to as the ETR, which stands for effective tax rate. It is calculated using the yearly pretax earnings and the annual tax paid by the firm. It is crucial for businesses to assess their tax status since they may be subject to taxation in many areas. The effective tax rate often called the long-run tax rate, is used to calculate NOPAT & ROIC. ETR is represented as a percentage and is computed as:

Despite its inherent complexity, tax cost should be evaluated in the same way as any other item of expenditure. As a result of laws in the places where the company does business. Tax treaties between countries and the regulations governing how enterprises within a similar family or set of companies are handled only add to the already convoluted situation. Consulting with a qualified tax professional is essential before beginning any in-depth study.

Income Statements & Rate of Taxation

Income statements provide a high-level summary of a firm's financial status for a certain time period, often one year or four quarters. Revenue from sales, COGS, gross margin, operational expenditures, operating profit, interest & dividend expense, tax liability, and net earnings may all be seen in an income statement. A corporation's profitability may primarily be ascertained via the income statement. Despite popular belief, a firm's tax rate is not disclosed in the income statement. However, the remainder of the data on the income statement may be used to calculate the effective tax rate.

How to Determine Your Tax Rate?

The entire tax rate that the business pays on its earned revenue is known as the effective tax rate. To get the effective tax rate, just divide the total income tax paid by the total pretax income. A company's tax bill is often the last line item on its income statement, just before the net profit total. If a business had pre-tax profits of $100,000 & spent $25,000 in taxes, its effective tax rate would be 25 percent (25,000/100,000). It is plain to see that the corporation's effective tax rate on income was 25%.

Marginal vs. Effective tax rate

The marginal tax rate is indeed the proportion at which an extra dollar of income is taxed; this rate is not always the same as the effective tax rate. The effective tax rate, which is often lower, is a more realistic portrayal of a person's or firm's entire tax burden than the marginal tax rate. It is the percentage at which a person or business enters a new tax band, whereas the effective tax rate is the rate at which they actually pay taxes. One's income is taxed at progressive rates in the United States. That's what tax experts call "progressive" since it increases in cost as income rises. Despite having the same amount of income in the highest marginal tax band, two people might have drastically different effective tax rates.

The Importance of the Effective Tax Rate

One statistic used by investors to gauge a firm's profitability is its effective tax rate. This figure is very unpredictable and may change drastically from one year to the next. It is not always easy to determine what causes a change in the effective tax rate. It's possible, for instance, that a business is participating in tax-avoidance strategies like manipulating its asset accounts rather than making genuine improvements in management and workflow.

Additionally, bear in mind that businesses often produce two separate financial statements, one of which is used for reporting—for example, the income statement. One is for regular usage, while the other is for taxation. It's possible for these two records to diverge due to differences in the treatment of expenses that qualify as tax write-offs or credits. An organization's effective tax rate may be reduced if it makes efficient use of tax deductions and credits, as compared to an organization that does not.